DOs

Always Use a Trading Plan

A trading plan is a set of rules that specifies a trader's entry, exit, risk and money management system .

Treat Trading Like a Business

Trading is a business and incurs expenses, losses, taxes, uncertainty, stress, and risk. As a trader, you are essentially a small business owner, and you must research and strategize to maximize your business's potential.

Protect Your Trading Capital

All traders have losing trades. Protecting capital entails not taking unnecessary risks and doing everything you can to preserve your trading business.

Become a Student of the Markets

Traders need to remain focused on learning more each day.

Always Use a Stop Loss

Using a stop loss can take some of the stress out of trading.

Before opening any position especially in the futures market, always check your liquidation point to make sure it's below or above your stop lose and if it's not, reduce your leverage to push it further to avoid complete liquidation of your margin.

DONTs

Don't Over Leverage

Just as your gains are higher with high leverage trading, so are your losses. One wrong trade can multiply your losses and even trigger a “margin call” where you must repay funds or your positions are closed.

Don't Trade without a Strategy

Trading without a pre-set strategy can lead to significant losses because a strategy allows you to systematically define how to pick tokens, when to buy and when to sell them.

Don't Trade With Emotions

Allowing emotions to drive investment decisions leads to irrational decision-making during market fluctuations. Do not let how you feel dictate your investment decisions, as this can lead to inconsistencies in your choices.

Lack of Patience

Crypto is a long-term investment, and it takes time to see significant returns. Expecting quick profits and panic selling during market corrections or dips, without considering long-term potential can be detrimental to your portfolio.

Don't Ignore Technical Analysis

Technical analysis can help traders identify trends, support and resistance levels, and potential market movements.

Don't Ignore Fundamental Analysis

Only seeing the price history of a token is not enough to decide on an investment. You must look into the team behind the project, its features and community engagement across social media to determine its worth.

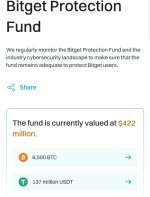

For those that will like to know where I trade my cryptocurrency, it's on Bitget, the exchange has good liquidity.

Always Use a Trading Plan

A trading plan is a set of rules that specifies a trader's entry, exit, risk and money management system .

Treat Trading Like a Business

Trading is a business and incurs expenses, losses, taxes, uncertainty, stress, and risk. As a trader, you are essentially a small business owner, and you must research and strategize to maximize your business's potential.

Protect Your Trading Capital

All traders have losing trades. Protecting capital entails not taking unnecessary risks and doing everything you can to preserve your trading business.

Become a Student of the Markets

Traders need to remain focused on learning more each day.

Always Use a Stop Loss

Using a stop loss can take some of the stress out of trading.

Before opening any position especially in the futures market, always check your liquidation point to make sure it's below or above your stop lose and if it's not, reduce your leverage to push it further to avoid complete liquidation of your margin.

DONTs

Don't Over Leverage

Just as your gains are higher with high leverage trading, so are your losses. One wrong trade can multiply your losses and even trigger a “margin call” where you must repay funds or your positions are closed.

Don't Trade without a Strategy

Trading without a pre-set strategy can lead to significant losses because a strategy allows you to systematically define how to pick tokens, when to buy and when to sell them.

Don't Trade With Emotions

Allowing emotions to drive investment decisions leads to irrational decision-making during market fluctuations. Do not let how you feel dictate your investment decisions, as this can lead to inconsistencies in your choices.

Lack of Patience

Crypto is a long-term investment, and it takes time to see significant returns. Expecting quick profits and panic selling during market corrections or dips, without considering long-term potential can be detrimental to your portfolio.

Don't Ignore Technical Analysis

Technical analysis can help traders identify trends, support and resistance levels, and potential market movements.

Don't Ignore Fundamental Analysis

Only seeing the price history of a token is not enough to decide on an investment. You must look into the team behind the project, its features and community engagement across social media to determine its worth.

For those that will like to know where I trade my cryptocurrency, it's on Bitget, the exchange has good liquidity.