SebsCubs

New member

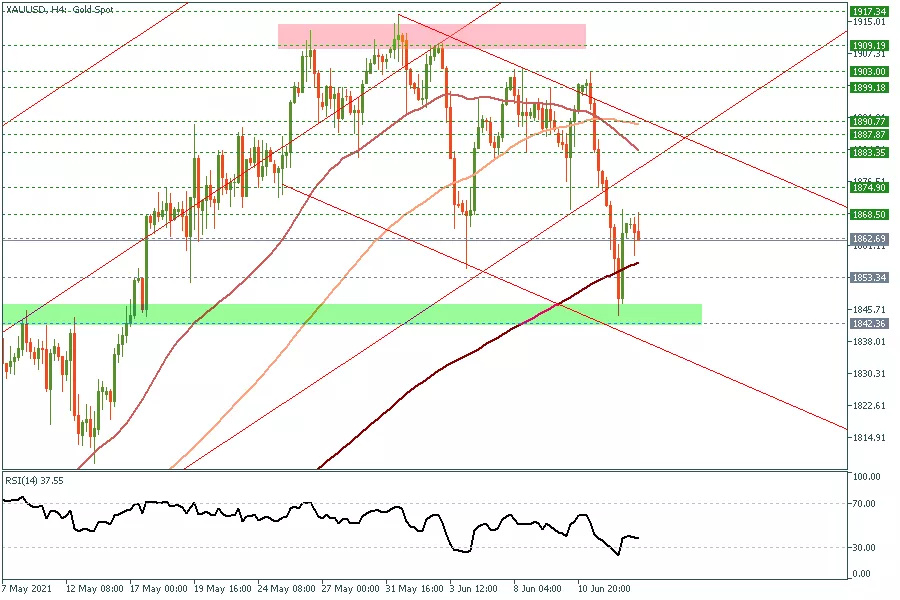

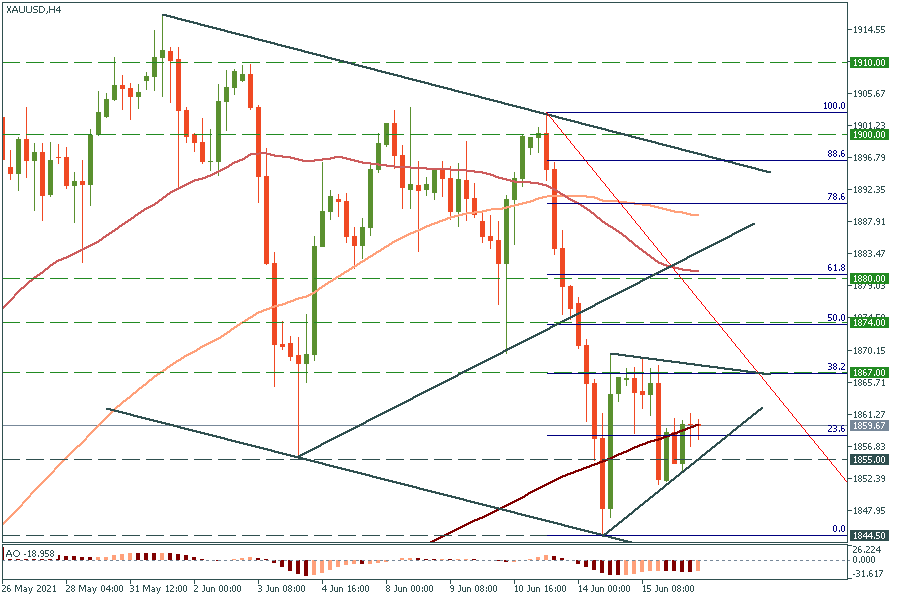

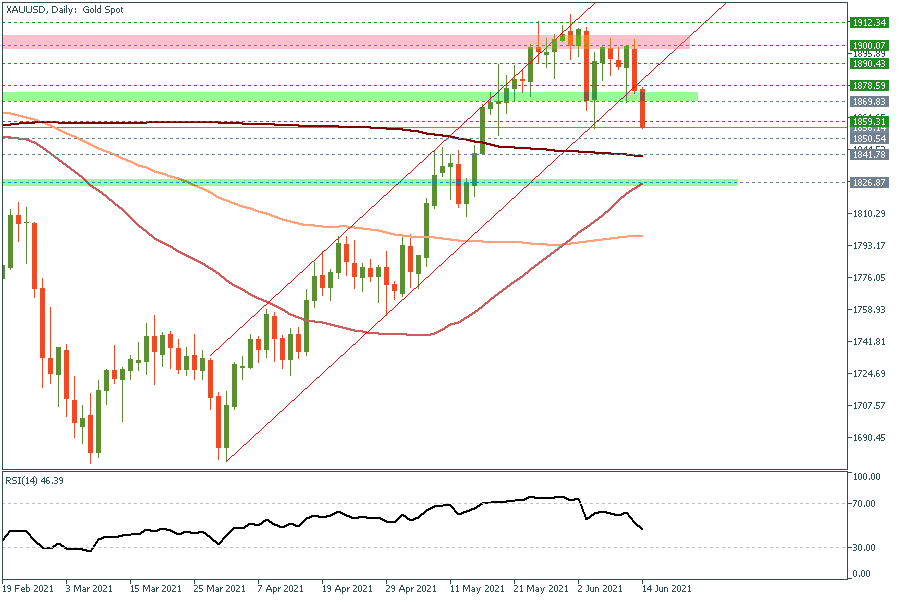

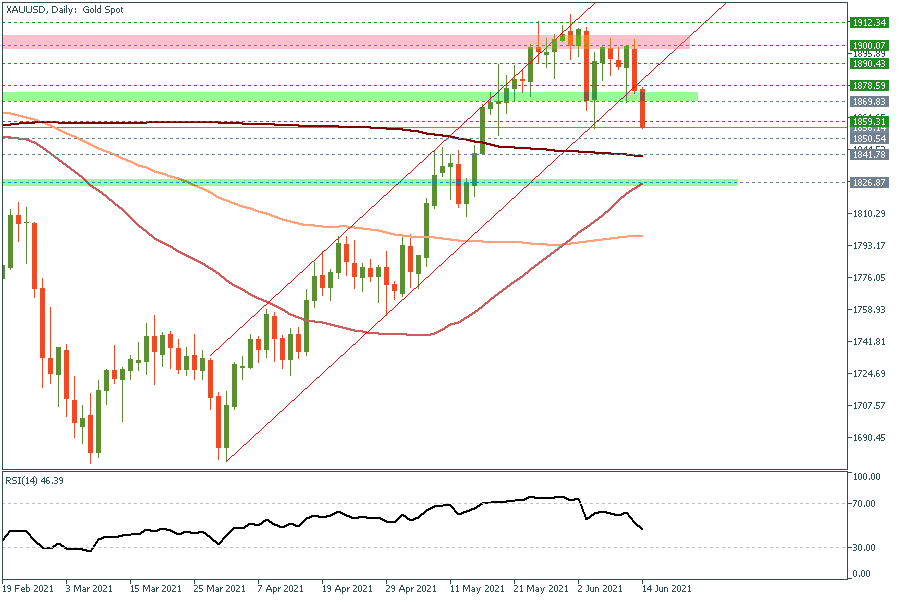

Gold prices tumbled on Friday and at beginning of the Asian session today, reaching as low as $1854/Oz, breaking through its upside channel on the daily chart, while the technical indicators are now clearly bearish, which confirms our short-term retracement outlook mentioned before since gold was trading above $1910. In the meantime, the key support for this week stands at $1840 which represents the 200-day MA, where gold is likely to show some stabilization, while we maintain our medium-term long positions that were issued back in April at $1710 and $1725 unchanged with a Stop Loss at $1730/Oz for now.

Reference: Gold's break down: what's next? (14.06.2021)

Reference: Gold's break down: what's next? (14.06.2021)