Raymondblue

Member

No doubt the impact of FTX crash has created a negative impression among crypto enthusiasts especially centralized exchange users. Of course FTX wasn't the first CEX to crash but its occurrence came as a shock looking at the position the crypto exchange occupies in terms of ranking and being the favourite cex for derivative trading before the sad event.

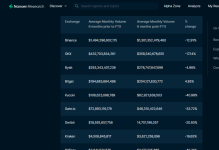

This has questioned the integrity of CEXs and a lot of users have embraced DEX while others opt for a more secure and transparent CEX. Talking about security and transparency as a mechanism to make users have complete trust in the remaining CEXs, two things comes to mind and that's "Proof of Reserve" and "User Protection Fund". This are obviously a good indicator and post FTX development but how effective could this be looking at the numerous crypto currency exchanges out there. Among the top 10 ranking CEXs, only Binance and Bitget has a veriable proof of users protection fund of $1B and $300M respectively. " Source from Nansen" Although some exchanges like OKX, Huobi and Bybit also claimed to have user protection funds but it is not publicly verifiable which of course raises eye brow about the integrity and transparency of such claim.

We can't actually do without CEX because we need it for our daily trading hence the reasons why more effective measures needs to be taken to secure users funds. Though Binance and Bitget seems to be on the right path but it's also important for this CEX to declare their Proof of Liabilities because FTX also did about two audits before it collapsed.

A lot of users are still skeptical keeping their assets on CEX due to fear of the unknown but could this development from Binance and Bitget restore trust and confidence back to users?

This has questioned the integrity of CEXs and a lot of users have embraced DEX while others opt for a more secure and transparent CEX. Talking about security and transparency as a mechanism to make users have complete trust in the remaining CEXs, two things comes to mind and that's "Proof of Reserve" and "User Protection Fund". This are obviously a good indicator and post FTX development but how effective could this be looking at the numerous crypto currency exchanges out there. Among the top 10 ranking CEXs, only Binance and Bitget has a veriable proof of users protection fund of $1B and $300M respectively. " Source from Nansen" Although some exchanges like OKX, Huobi and Bybit also claimed to have user protection funds but it is not publicly verifiable which of course raises eye brow about the integrity and transparency of such claim.

We can't actually do without CEX because we need it for our daily trading hence the reasons why more effective measures needs to be taken to secure users funds. Though Binance and Bitget seems to be on the right path but it's also important for this CEX to declare their Proof of Liabilities because FTX also did about two audits before it collapsed.

A lot of users are still skeptical keeping their assets on CEX due to fear of the unknown but could this development from Binance and Bitget restore trust and confidence back to users?