It has been 12 years since the birth of cryptocurrency. Meanwhile, crypto contract trading also dates back a very long time. Contracts have always been one of the most popular crypto derivatives and even attracted many beginner investors. However, most newbies are confused by some of the basic concepts of crypto contracts. Therefore, you should first study such basic concepts before starting to trade contracts if you are new to this crypto category.

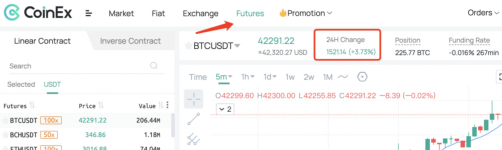

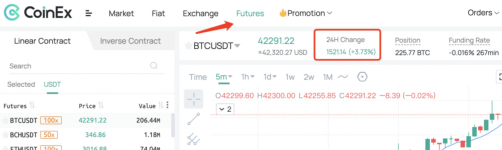

Investors can trade contracts on a crypto exchange. For instance, CoinEx now features multiple futures markets for linear/inverse futures contracts, with a maximum leverage ratio of 100X.

The primary feature of futures is the adoption of the Funding Fee mechanism, which pegs the futures price to the spot price. In addition, as there is no delivery date, futures introduced a concept called the spot index price and peg the market price of futures to the spot price through the Funding Fee mechanism. On CoinEx, the Funding Fee is paid/received every 8 hours.

If the Funding Rate is positive, long traders will pay the Funding Fee to short traders; if the rate is negative, on the other hand, short traders will pay the Funding Fee to long traders. It should be noted that only traders with an opening position on the settlement hour need to pay/receive the fee. Meanwhile, the Funding Fee is settled only between long traders and short traders, and CoinEx does not participate in the payment/receipt of the Funding Fee.

Suppose the BTC price goes down when you trade linear futures contracts, the price drop will not affect the value of the underlying asset (USDT) as it is a stablecoin. What this means is that you could avoid the losses arising from price swings of cryptos like BTC and ETH that are required for opening a position and margin payment when you trade inverse futures contracts.

On CoinEx, inverse futures contracts, unlike linear futures contracts, are coin-margined contracts that can only be traded when you hold the settlement coin (e.g. BTC, ETH). In the case of a BTCUSD inverse contract, for instance, though the contract is priced in USD, it is settled with BTC. Suppose the crypto prices go up when you are longing inverse futures contracts with BTC and ETH, you will profit from the price surge, in addition to the long profit, because you will earn the settlement coin when trading these contracts.

As futures trading comes with its risks, beginners should make prudent investment decisions after having fully examined the basic concepts and the relevant facts about crypto futures.

What is crypto contract trading?

In the crypto space, contract trading allows investors to profit from the rising/falling crypto prices by buying long or selling short. Crypto contracts are similar to conventional contracts, and the only difference between them is that the underlying assets of the former are cryptocurrencies like Bitcoin or Ethereum.Investors can trade contracts on a crypto exchange. For instance, CoinEx now features multiple futures markets for linear/inverse futures contracts, with a maximum leverage ratio of 100X.

What is futures trading in the crypto context?

Crypto futures are a kind of innovative financial derivatives that works like a market of secured assets, and the price of crypto futures is close to the index price of the underlying assets. Unlike conventional futures, crypto futures do not expire. As such, when trading crypto futures, you may hold the futures until liquidation. For example, on CoinEx, all crypto contracts traded are futures that are available 24/7. In addition, they do not expire and will not be settled.The primary feature of futures is the adoption of the Funding Fee mechanism, which pegs the futures price to the spot price. In addition, as there is no delivery date, futures introduced a concept called the spot index price and peg the market price of futures to the spot price through the Funding Fee mechanism. On CoinEx, the Funding Fee is paid/received every 8 hours.

If the Funding Rate is positive, long traders will pay the Funding Fee to short traders; if the rate is negative, on the other hand, short traders will pay the Funding Fee to long traders. It should be noted that only traders with an opening position on the settlement hour need to pay/receive the fee. Meanwhile, the Funding Fee is settled only between long traders and short traders, and CoinEx does not participate in the payment/receipt of the Funding Fee.

What are linear/inverse futures contracts?

On CoinEx, linear futures contracts are also called USDT-margined contracts. One feature of such contracts is that investors only need to hold USDT, a stablecoin. In the case of a BTCUSDT linear futures contract, for example, the contract is priced in USDT and also settled with USDT. The advantage of these contracts is that you can trade multiple types of cryptos as long as you hold USDT, which helps you avoid the risks of price swings and lowers the cost of switching between different positions.Suppose the BTC price goes down when you trade linear futures contracts, the price drop will not affect the value of the underlying asset (USDT) as it is a stablecoin. What this means is that you could avoid the losses arising from price swings of cryptos like BTC and ETH that are required for opening a position and margin payment when you trade inverse futures contracts.

On CoinEx, inverse futures contracts, unlike linear futures contracts, are coin-margined contracts that can only be traded when you hold the settlement coin (e.g. BTC, ETH). In the case of a BTCUSD inverse contract, for instance, though the contract is priced in USD, it is settled with BTC. Suppose the crypto prices go up when you are longing inverse futures contracts with BTC and ETH, you will profit from the price surge, in addition to the long profit, because you will earn the settlement coin when trading these contracts.

As futures trading comes with its risks, beginners should make prudent investment decisions after having fully examined the basic concepts and the relevant facts about crypto futures.