In the world of cryptocurrency, one common way to make a profit is by selling your investment when the market price goes up. However, there are other methods to make money in crypto, such as staking. Staking enables you to utilize your digital assets to generate passive income without the necessity of selling them.

Staking is somewhat similar to depositing cash in a high-yield savings account. Just like how banks lend out your deposits and you earn interest on your account balance, staking involves locking up your crypto assets for a specific period. In return, you earn more cryptocurrency.

This article covers topics such as understanding staking, proof of stake validation, how staking operates, and methods for earning profits through staking cryptocurrencies.

Staking is when you hold onto your crypto assets for a certain period to help the blockchain function better. In exchange for staking, you receive more cryptocurrency. Many blockchains use a proof of stake consensus mechanism, where participants validate new transactions and add new blocks by staking set sums of cryptocurrency.

Staking ensures that only valid data and transactions are added to a blockchain. Those looking to validate new transactions offer to lock up their cryptocurrency as a form of insurance. If they validate incorrect data, they may lose some or all of their stake as a penalty. But if they validate correct transactions, they earn more cryptocurrency as a reward.

Proof of stake validation is crucial for these cryptocurrencies to function effectively. Typically, the larger the stake, the better the chance validators have to add new blocks and earn rewards. Validators can accumulate stake delegations from multiple holders, which serves as proof to the network that their consensus votes are trustworthy.

Additionally, a stake doesn't necessarily have to consist of just one person's tokens. For instance, holders can participate in staking pools, where stake pool operators handle the validation of transactions on the blockchain.

When you opt for a staking program, it outlines the rewards it offers. For instance, the trusted crypto exchange Koinpark provides staking services with an annual percentage yield (APY) ranging from 15% to 40% for XRP staking.

To begin staking with Koinpark, users must stake a minimum of 150 XRP in the pool.

Once you've committed to staking crypto, you'll receive the promised return as per the schedule.

The program will give you the rewards in the cryptocurrency you staked. You can decide to keep it as an investment, stake it again, or trade it for cash or other cryptocurrencies.

Investing in Bitcoin during its halving event is a strategy that allows us to hold onto the cryptocurrency and stake it to earn additional passive income and rewards. Choosing the best exchange platform to buy Bitcoin is essential to ensure security.

Among the many choices out there, Koinpark shines as a reliable global cryptocurrency exchange. It prioritizes safety measures and is registered in the AML compliance register.

With features like 2FA security and an intuitive cryptocurrency exchange app, Koinpark facilitates smooth trading experiences. Additionally, it provides access to over 150+ cryptocurrencies for trading.

For individuals in the Indian region seeking guidance on how to buy Bitcoin in India, Koinpark is recommended as the best exchange platform to buy Bitcoin in India.

Moreover, Koinpark offers the option to stake Bitcoin to earn passive income,

You can confidently Buy Bitcoin and other cryptocurrencies through Koinpark. If you're unsure about trading Bitcoin, you can refer to their blog post on "How to buy Bitcoin in India'' for further assistance.

Staking is somewhat similar to depositing cash in a high-yield savings account. Just like how banks lend out your deposits and you earn interest on your account balance, staking involves locking up your crypto assets for a specific period. In return, you earn more cryptocurrency.

This article covers topics such as understanding staking, proof of stake validation, how staking operates, and methods for earning profits through staking cryptocurrencies.

What is Staking?

Staking is when you hold onto your crypto assets for a certain period to help the blockchain function better. In exchange for staking, you receive more cryptocurrency. Many blockchains use a proof of stake consensus mechanism, where participants validate new transactions and add new blocks by staking set sums of cryptocurrency.

Staking ensures that only valid data and transactions are added to a blockchain. Those looking to validate new transactions offer to lock up their cryptocurrency as a form of insurance. If they validate incorrect data, they may lose some or all of their stake as a penalty. But if they validate correct transactions, they earn more cryptocurrency as a reward.

Proof of stake validation

Proof of stake validation is crucial for these cryptocurrencies to function effectively. Typically, the larger the stake, the better the chance validators have to add new blocks and earn rewards. Validators can accumulate stake delegations from multiple holders, which serves as proof to the network that their consensus votes are trustworthy.

Additionally, a stake doesn't necessarily have to consist of just one person's tokens. For instance, holders can participate in staking pools, where stake pool operators handle the validation of transactions on the blockchain.

How does staking work?

- If you own a cryptocurrency that operates on a proof-of-stake blockchain, you can stake your tokens.

- Staking locks up your assets to help maintain the security of the network's blockchain.

- In return for locking up your assets and participating in-network validation, validators receive rewards in the form of staking rewards.

The benefits of staking crypto

- Earning passive income: If you're not planning to sell your cryptocurrency tokens shortly, staking allows you to earn passive income that you wouldn't have generated otherwise from your cryptocurrency investment.

- Easy to get started: you can quickly begin with an exchange or crypto wallet.

How To Make Money by Staking Crypto?

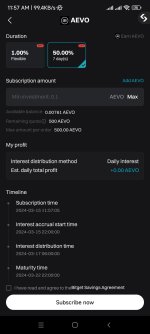

When you opt for a staking program, it outlines the rewards it offers. For instance, the trusted crypto exchange Koinpark provides staking services with an annual percentage yield (APY) ranging from 15% to 40% for XRP staking.

To begin staking with Koinpark, users must stake a minimum of 150 XRP in the pool.

Once you've committed to staking crypto, you'll receive the promised return as per the schedule.

The program will give you the rewards in the cryptocurrency you staked. You can decide to keep it as an investment, stake it again, or trade it for cash or other cryptocurrencies.

Pro Tips

Investing in Bitcoin during its halving event is a strategy that allows us to hold onto the cryptocurrency and stake it to earn additional passive income and rewards. Choosing the best exchange platform to buy Bitcoin is essential to ensure security.

Among the many choices out there, Koinpark shines as a reliable global cryptocurrency exchange. It prioritizes safety measures and is registered in the AML compliance register.

With features like 2FA security and an intuitive cryptocurrency exchange app, Koinpark facilitates smooth trading experiences. Additionally, it provides access to over 150+ cryptocurrencies for trading.

For individuals in the Indian region seeking guidance on how to buy Bitcoin in India, Koinpark is recommended as the best exchange platform to buy Bitcoin in India.

Moreover, Koinpark offers the option to stake Bitcoin to earn passive income,

You can confidently Buy Bitcoin and other cryptocurrencies through Koinpark. If you're unsure about trading Bitcoin, you can refer to their blog post on "How to buy Bitcoin in India'' for further assistance.