Venus1100

Active member

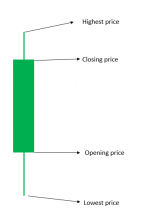

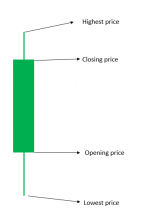

Based on your chosen timeframe, each candlestick indicates a period of trading time (one day, one hour, or one minute). A red candle signifies that the closing price is lower than the beginning price, indicating that the asset price has dropped. A green candle means the closing price is higher than the initial price, indicating an asset price gain. The candlestick chart can be used by investors to determine short- and long-term market movements.

Candlesticks have top and lower shadows as well as candle bodies. The transaction is represented by the candle body, and the price is represented by the shadow.

The Benefits and Drawbacks of Using the Candlestick Pattern

Advantages: Each candlestick is essentially a record of the price movement over time. The creation of a candlestick cancels out the noise created by the passage of time. Novice investors can establish more strong short- and mid-term trading strategies by referring to the K-line chart.

Cons: Candlestick chart technology was developed in the early twentieth century and is still in its infancy. Drawing K-line charts is difficult, especially during periods of significant market volatility, and selecting points and forming K-line charts is difficult. As a result, K-line chart technical analysis methodologies are currently being developed.

Candlesticks have top and lower shadows as well as candle bodies. The transaction is represented by the candle body, and the price is represented by the shadow.

The Benefits and Drawbacks of Using the Candlestick Pattern

Advantages: Each candlestick is essentially a record of the price movement over time. The creation of a candlestick cancels out the noise created by the passage of time. Novice investors can establish more strong short- and mid-term trading strategies by referring to the K-line chart.

Cons: Candlestick chart technology was developed in the early twentieth century and is still in its infancy. Drawing K-line charts is difficult, especially during periods of significant market volatility, and selecting points and forming K-line charts is difficult. As a result, K-line chart technical analysis methodologies are currently being developed.