Maxicreed

Active member

Recently, we don't see the hype news of launch or publishing of the state of exchanges proof of reserves. The trend seems to have drifted towards protection fund.

I can't trace the inception of user protection funds unlike the PoR reserve that was introduced due to the FTX debacle. What I can think of is that the Binance SAFU fund may have birthed the idea.

Is this the right step and is it the yard stick to determine a good trading platform? Tho only a few have this arrangement on their platform.

What inspired me to ask or write this content is their choice of investing of these funds on few selected coin and how those investments choice seems to be appreciating in value for the affected exchanges.

Binance SAFU is in BTC, ETH, USDT and TUSD (Valued above $I billion)

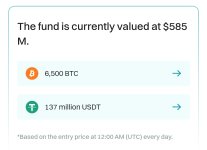

Bitget: Protection funds is in BTC, USDT, and USDC (Current value approaching $600 million)

HTX's also only in BTC. ( will appreciate more details)

OKX and Coinbase has similar arrangements as reported by coin telegraph at one point but I don't have much to share.

The increase in the afore-mentioned protection funds value is obviously attributed to current market sentiment which I feel is another good approach towards improving assets security but the big question is 'are we about seeing a shift in the security of centralized exchange and how safe do we perceive this concept?'

I can't trace the inception of user protection funds unlike the PoR reserve that was introduced due to the FTX debacle. What I can think of is that the Binance SAFU fund may have birthed the idea.

Is this the right step and is it the yard stick to determine a good trading platform? Tho only a few have this arrangement on their platform.

What inspired me to ask or write this content is their choice of investing of these funds on few selected coin and how those investments choice seems to be appreciating in value for the affected exchanges.

Binance SAFU is in BTC, ETH, USDT and TUSD (Valued above $I billion)

Bitget: Protection funds is in BTC, USDT, and USDC (Current value approaching $600 million)

HTX's also only in BTC. ( will appreciate more details)

OKX and Coinbase has similar arrangements as reported by coin telegraph at one point but I don't have much to share.

The increase in the afore-mentioned protection funds value is obviously attributed to current market sentiment which I feel is another good approach towards improving assets security but the big question is 'are we about seeing a shift in the security of centralized exchange and how safe do we perceive this concept?'