When trading futures, sometimes, the total asset of your position might go down even though the ROI stays positive. Why? In such cases, the part of the total asset you lost has been taken away by the exchange as the service fee for the current round of liquidation. Therefore, some veteran traders often advise newbies to focus on observation, rather than trading. Trading futures frequently affects a trader’s mindset, reduces the likelihood of winning, and increases the trading cost. The service fee could be very expensive as it adds up over the long run.

The goal of trading on a crypto exchange is always profit, and blinded trading without learning the rules governing how the service fee is charged on a platform will often bring losses. Right now, the service fee for futures trading on mainstream exchanges consists of two parts: 1) Transaction Fee, and 2) Funding Fee.

It should be noted that the Maker Fee is generally lower than the Taker Fee, which is understandable because Makers bring more liquidity to the market by placing orders, while Takers consume liquidity by accepting orders. As such, the Maker Fee is lower than the Taker Fee on most exchanges.

Learn more about Maker and Taker here.

Suppose a regular user is trading cryptos on CoinEx, and he would have to pay the following fees:

Is there a way to pay less fee?

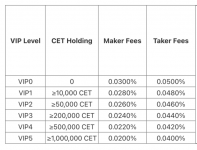

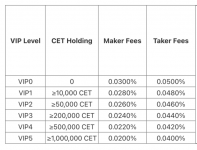

The answer is yes. Right now, many exchanges have offered many benefits to lower the trading threshold for users. For example, on CoinEx, the Maker/Taker Fee for retail users stands at 0.03%/0.05%. However, when a user’s CET holding reaches a certain level, the Maker/Taker Fee will go down.

In addition to the Transaction Fee, the Funding Fee will also affect a trader’s cost. When the futures price is higher than the spot price, the exchange will announce a positive Funding Rate, which means that the Funding Fee will be paid by long traders to short traders; if the Funding Rate becomes negative when the futures price is lower than the spot price, then the Funding Fee is paid by short traders to long traders. It is noteworthy that the Funding Rate is never fixed. Instead, it varies according to market fluctuations and is determined by the long-short ratio of a market.

On CoinEx, the Funding Fee is settled every 8 hours at 0:00, 08:00, and 16:00 (UTC). Users only have to pay/receive the Funding Fee if they hold a position at these three timestamps. If a position is closed before the fee is charged, then no Funding Fee will be paid. In addition, the Funding Fee only circulates between traders and is not charged by CoinEx.

The goal of trading on a crypto exchange is always profit, and blinded trading without learning the rules governing how the service fee is charged on a platform will often bring losses. Right now, the service fee for futures trading on mainstream exchanges consists of two parts: 1) Transaction Fee, and 2) Funding Fee.

Transaction Fee

When trading futures, both Makers and Takers will have to pay a Transaction Fee. In particular, the Maker Fee might differ from the Taker Fee, and different exchanges have different rules about the rate for Makers and Takers.It should be noted that the Maker Fee is generally lower than the Taker Fee, which is understandable because Makers bring more liquidity to the market by placing orders, while Takers consume liquidity by accepting orders. As such, the Maker Fee is lower than the Taker Fee on most exchanges.

Learn more about Maker and Taker here.

Suppose a regular user is trading cryptos on CoinEx, and he would have to pay the following fees:

User A is trading linear contracts. He starts a long position of 1 BTC with 400 USDT (a leverage ratio of 100X) when the BTC price is at 40,000 UDST and sells the entire position at 50,000 UDST, then User A will have to pay the following fee:Maker: 0.03%

Taker: 0.05%

Linear Contract’s Trading Fee = Fee rate * Position Qty * Buying/Selling Price

Inverse Contract’s Trading Fee = Fee rate * Contract Amount * Contract Value * Buying/Selling Price

The Transaction Fee for inverse contracts can also be determined by the above formula. In short, we can tell that although User A profits from the deal, he has to pay 35 USDT in Transaction Fee alone, which is roughly 1/10 of his principal. Though the fee may seem minimal, it could become a very expensive cost as it adds up over the long run.Transaction Fee for opening the position = 0.05%*1*40,000 USDT = 20 USDT

Transaction Fee for closing the position = 0.03%*1*50,000 USDT = 15 USDT

Is there a way to pay less fee?

The answer is yes. Right now, many exchanges have offered many benefits to lower the trading threshold for users. For example, on CoinEx, the Maker/Taker Fee for retail users stands at 0.03%/0.05%. However, when a user’s CET holding reaches a certain level, the Maker/Taker Fee will go down.

Funding Fee

In a market of crypto contracts, apart from futures, there are also delivery contracts, which are settled monthly/quarterly. Such regular settlements make sure that the market price of delivery contracts stays the same as the spot price. Futures, on the other hand, do not have a settlement date, which means that traders may hold onto them indefinitely. As such, if there is no price correction mechanism, the price gap between spot and futures will become increasingly larger. To bring the futures price back to the level of the spot price, a correction mechanism is needed to minimize the price gap, which triggered the invention of the Funding Fee.In addition to the Transaction Fee, the Funding Fee will also affect a trader’s cost. When the futures price is higher than the spot price, the exchange will announce a positive Funding Rate, which means that the Funding Fee will be paid by long traders to short traders; if the Funding Rate becomes negative when the futures price is lower than the spot price, then the Funding Fee is paid by short traders to long traders. It is noteworthy that the Funding Rate is never fixed. Instead, it varies according to market fluctuations and is determined by the long-short ratio of a market.

On CoinEx, the Funding Fee is settled every 8 hours at 0:00, 08:00, and 16:00 (UTC). Users only have to pay/receive the Funding Fee if they hold a position at these three timestamps. If a position is closed before the fee is charged, then no Funding Fee will be paid. In addition, the Funding Fee only circulates between traders and is not charged by CoinEx.

Conclusion

- In addition to the PNL of their position, futures traders must also pay Transaction Fee and Funding Fee;

- Though the Transaction Fee must be paid, traders may reduce the trading cost by avoiding frequent trades or becoming VIP users;

- When the Funding Rate is positive, the Funding Fee is paid by long traders to short traders; when the Funding Rate is negative, the Funding Fee is paid by short traders to long traders;

- CoinEx does not charge any Funding Fee. Instead, the fee is paid by/to traders. On CoinEx, the Funding Fee is settled every 8 hours.